Universitetsavisen

Nørregade 10

1165 København K

Tlf: 35 32 28 98 (mon-thurs)

E-mail: uni-avis@adm.ku.dk

Ph.d.-forsvar

Ph.d.-forsvar — Gregers Nytoft Rasmussen forsvarer sin ph.d.-afhandling "Patience, Risk Aversion, and Economic Behavior: Combining Experimental Data with Administrative Register Data".

Date & Time:

Place:

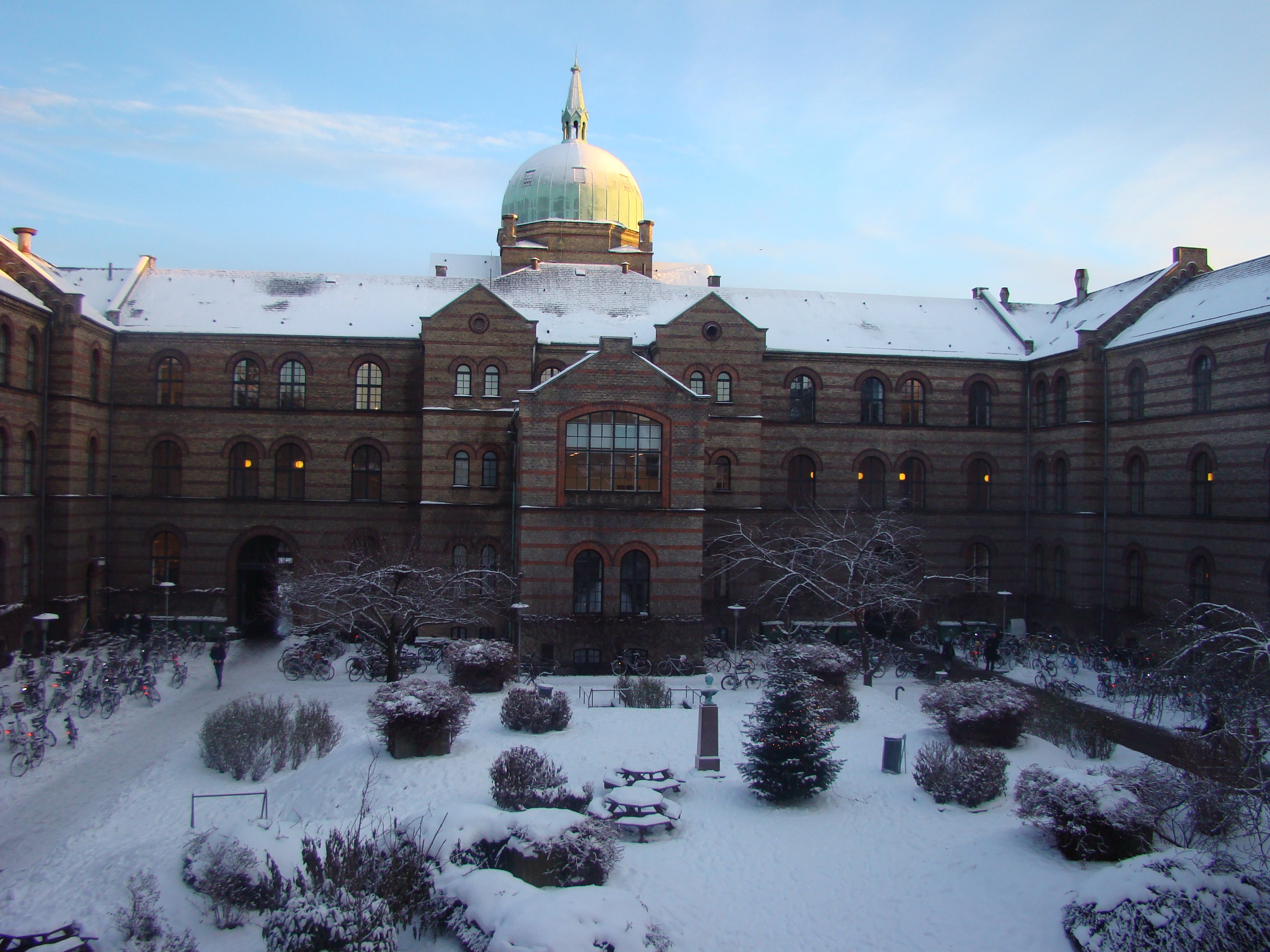

Københavns Universitet, Center for Sundhed og Samfund, Øster Farimagsgade 5, Økonomisk Institut, bygning 35, lokale 35.3.13 (Indgang fra Gammeltoftgade er nemmest).

Hosted by:

Økonomisk Institut

Cost:

Free

Kandidat

Gregers Nytoft Rasmussen

Titel

“Patience, Risk Aversion, and Economic Behavior: Combining Experimental Data with Administrative Register Data“. Det vil være muligt før forsvaret at rekvirere en kopi af afhandlingen ved henvendelse til Informationen (26.0.20), Økonomisk Institut.

Tid og sted

Fredag den 15. december 2017 kl. 13.00. Københavns Universitet, Center for Sundhed og Samfund, Øster Farimagsgade 5, Økonomisk Institut, bygning 35, lokale 35.3.13 (Indgang fra Gammeltoftgade er nemmest). Af hensyn til kandidaten lukkes dørene præcis.

Bedømmelsesudvalg

Resumé

In models of economic behavior, assumptions about preferences are essential. Empirical knowledge about preferences is therefore important in explaining the behavior of individuals. This PhD thesis studies relationships between preferences and economic decision-making at the individual level. The work presented here is based on large-scale Internet experiments with more than 5,000 Danish respondents. The experiments involved incentivized intertemporal choices and investment choices designed to elicit measures of individual-level patience and risk aversion. The experimental preference measures are linked at the individual level to Danish third-party reported administrative register data. The work in this thesis distinguishes itself by facilitating a comparison between experimentally elicited preferences and long-term real-life economic behavior observed in the registers, while earlier studies have primarily evaluated the relationships between preferences and economic decision-making in short-term laboratory settings.

The thesis consists of three self-contained chapters, which all contribute to the understanding of how heterogeneity in preferences relates to actual economic decision-making at the individual level. In chapter 1, I document that time and risk preferences are important for behavior on the loan market in terms of several outcomes: loan to income ratios, the timing of first debt incurrence, interest rates paid on debt, the choice of mortgage loan, and delinquencies on loans. Chapter 2 investigates the relationship between time discounting and wealth inequality. We find a strong positive correlation between measured patience levels and the respondents’ positions in the wealth distribution. In chapter 3, I study the association between preference heterogeneity and insurance demand and find positive relationships between insurance purchases and levels of risk aversion as well as patience.