Universitetsavisen

Nørregade 10

1165 København K

Tlf: 21 17 95 65 (man-fre kl. 9-15)

E-mail: uni-avis@adm.ku.dk

Konference

Konference — The general aim of the conference is to contribute to the improvement of the legal base and regulation of IDCPs across the EU by sharing and discussing the existing regulatory models, within which the Scandinavian model plays a central role.

Date & Time:

Place:

Online and in Flexroom, 8A-0-57. Faculty of Law, University of Copenhagen, Karen Blixens Plads 16, 2300 Copenhagen S

Hosted by:

CME - Centre for Market and Economy Law. Faculty of Law, University of Copenhagen

Cost:

Free

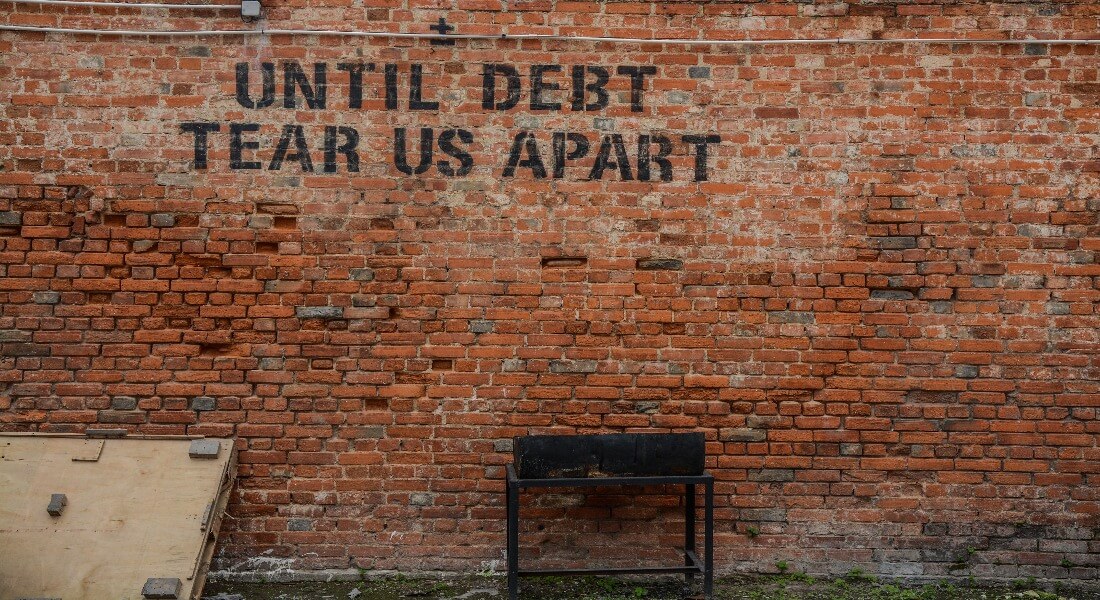

The loss of jobs and the decline in real incomes caused by the 2008 financial crisis and the COVID-19 pandemic have affected consumers’ ability to repay their debts. This has led to high ratios of non-performing loans (NPLs), which affect the stability of the financial industry and undermine economic recovery. The result has been a drastic increase in informal debt collection practices (IDCPs).

Debt collection begins when a creditor determines that a consumer is behind on payments and must be contacted about repaying their debt. Generally, the debt collection process can be divided into two categories, formal and informal, depending on whether the state apparatus (i.e., courts and bailiffs) is involved in the process. Most creditors prefer to use IDCPs because they are cheaper, faster, and less risky than formal processes. However, (IDCPs) can become abusive if the creditor engages in impermissible conduct to extract payment.

Abusive IDCPs encompass all methods of private enforcement that a creditor employs for debt recovery that a) do not involve the judiciary or state agents and b) threaten consumers’ physical, psychological, or economic wellbeing. Abusive IDCPs may often involve violence, harassment, and invasion of privacy. Subjecting consumer-debtors to such practices may cause family hardship, public shaming, social exclusion, or psychological and relationship issues while increasing over-indebtedness. Moreover, ethical and law-abiding debt collectors are exposed to unfair competition, as unethical collectors will have a higher recovery rate. The functioning of the financial system is also affected since consumers confronted with abusive IDCPs are reluctant to access credit in the future. In addition, the economy is hurt because abusive debt collectors use regulatory and tax arbitrage to divert profits and avoid tax contributions. Ultimately, abusive IDCPs affect consumers’ access to justice and effective remedies as long as they remain unregulated.

The World Bank warns that consumers are exposed to “aggressive debt collection practices and late payment or default fees” as a direct result of the COVID-19 recession, emphasizing that “enhanced monitoring of aggressive and unscrupulous debt collection activities is crucial during these times” (emphasis added).

Despite the serious harms of IDCPs, they remain largely unregulated at both the member state (MS) and the European Union (EU) level. According to a 2020 survey, only nine MS regulate them: Belgium, Denmark, Germany, Greece, Estonia, Finland, the Netherlands, Romania and Sweden. Thus, two-thirds of EU consumer-debtors (281.47 million people) lack adequate protections due to the absence of national sector-specific legislation, while EU-wide regulation (i.e., the Unfair Commercial Practices Directive) plays only a marginal part. Moreover, the existing regulatory frameworks display significant idiosyncratic features, which creates disruptions in the collection process (thus affecting the performance of financial services) for it leads to unjustified different treatments of consumer-debtors and fosters regulatory arbitrage.

This raises two key questions: 1) How can IDCPs be regulated effectively? 2) Should a solution be adopted at EU or MS level?

The general aim of the conference is to contribute to the improvement of the legal base and regulation of IDCPs across the EU by sharing and discussing the existing regulatory models, within which the Scandinavian model plays a central role. Moreover, it will create a venue for dialogue between academics, experts, practitioners, to bring to forefront both issues, policy considerations and solutions concerning abusive IDCPs in Scandinavia and the EU. In doing this, the conference will consider that well-functioning, private enforcement mechanisms such as IDCPs should ensure that no imbalance will occur between the interests of creditors to speedy and cheap debt-recovery and those of consumer-debtors not to be subjected to abusive IDCPs. Ultimately, it will constitute the stepping stone for a collaborative project, in the form of a monograph, to be published by 2022.

Considering all the above, the topic is of interest not only to the debt collection industry and consumer-debtors, but also to national and EU legislators or regulators, practitioners, NGOs, and policy makers for it touches upon key EU prerogatives such as the proper functioning of the internal market, consumer welfare and fair competition.

See program and register for either online or physical participation no later than 1/9, 10.00 here